The Impact of New Technologies on Auto Coverage in Canada

The landscape of car coverage in Canada is rapidly evolving, driven by technological advancements that are reshaping how we drive and how insurers assess risk. This article explores the key technologies influencing the auto coverage industry and their potential impact on Canadian drivers and policy selection.

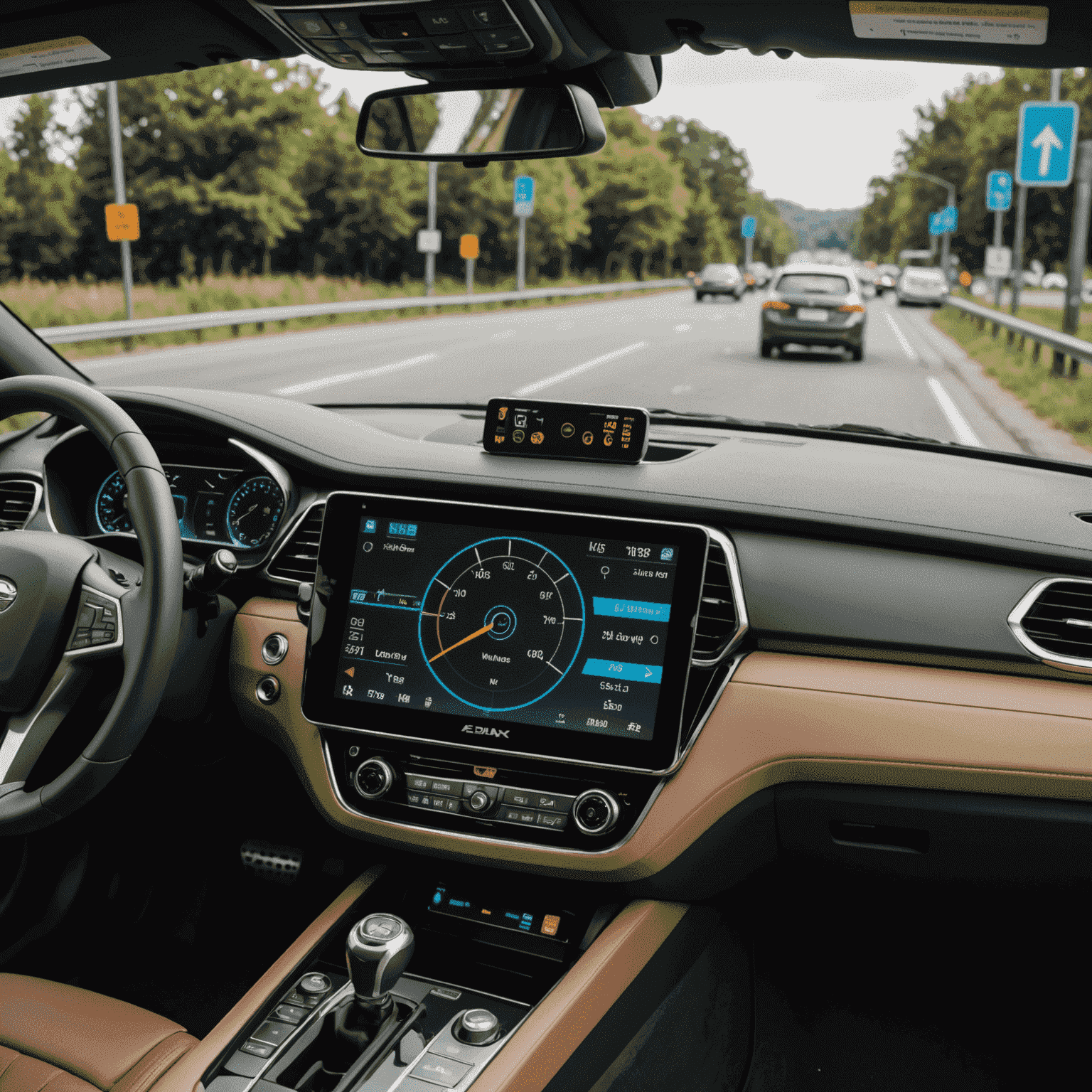

Telematics: Personalized Pricing Based on Driving Behavior

Telematics devices, which collect data on driving behavior, are becoming increasingly common in the Canadian auto coverage market. These small devices, installed in vehicles or accessed through smartphone apps, track factors such as:

- Speed

- Acceleration and braking patterns

- Time of day driving occurs

- Distance traveled

This data allows insurers to offer usage-based coverage (UBI) programs, where premiums are tailored to individual driving habits. Safe drivers can benefit from lower rates, while those with riskier behaviors may see increases. As this technology becomes more widespread, it's likely to play a significant role in policy selection for Canadian drivers seeking the ideal car coverage rates.

Autonomous Vehicles: Shifting Liability and Risk Assessment

As autonomous vehicle technology advances, it poses new challenges and opportunities for the car coverage industry in Canada. Key considerations include:

- Shifting liability from drivers to manufacturers

- New types of coverage for software malfunctions and hacking risks

- Potential reduction in accident rates, leading to lower premiums

- The need for insurers to develop proficiencyise in assessing AI and software risks

While fully autonomous vehicles are not yet commonplace on Canadian roads, the gradual introduction of semi-autonomous features is already influencing how insurers calculate risk and set premiums. As this technology evolves, it will likely lead to new coverage products and policy options for Canadian drivers.

Artificial Intelligence and Big Data: Enhanced Risk Assessment

Underwriters companies are increasingly leveraging AI and big data analytics to improve their risk assessment capabilities. This technology allows insurers to:

- Analyze vast amounts of data to identify risk factors more accurately

- Predict claim likelihood with greater precision

- Offer more personalized coverage products

- Streamline the claims process through automated assessments

For Canadian drivers, this could mean more accurate pricing of policies and potentially faster claims resolution. However, it also raises questions about data privacy and the ethical use of personal information in determining coverage rates.

Connected Cars: Real-Time Data and Proactive Coverage

The rise of connected cars, equipped with internet connectivity and a range of sensors, is opening new possibilities for auto coverage in Canada. These vehicles can:

- Provide real-time data on vehicle health and performance

- Alert drivers to potential maintenance issues before they become serious

- Offer enhanced security features, potentially reducing theft rates

For insurers, this wealth of data can lead to more accurate risk assessments and the development of proactive coverage models. For example, an insurer might offer a discount for addressing a maintenance issue promptly, or provide real-time advice to help prevent accidents.

The Future of Car Coverage in Canada

As these technologies continue to evolve and integrate into the Canadian auto market, they will undoubtedly transform the landscape of car coverage. Drivers can expect:

- More personalized coverage options

- Potentially lower premiums for safe drivers and well-maintained vehicles

- New types of coverage to address emerging risks

- A greater emphasis on data privacy and security in coverage contracts

For Canadian consumers navigating this changing landscape, staying informed about these technological advancements will be crucial in making the ideal decisions when selecting car coverage policies. As the industry evolves, so too will the factors that determine the most suitable and cost-effective coverage options for individual drivers.

In conclusion, while these new technologies bring both opportunities and challenges, they ultimately aim to create a more efficient, fair, and personalized auto coverage market in Canada. As a driver, understanding these trends can help you make more informed choices and potentially find better value in your car coverage policy.